On the ‘Fairness’ of Forgiving Student Loan Debt

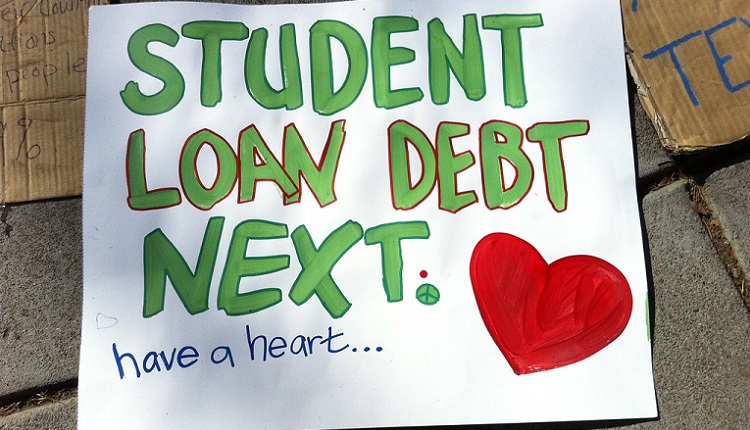

As we slow-walk toward another presidential election, several candidates are discussing new directions for America. One of those directions includes the controversial topic of student loan debt forgiveness. You can visit the official campaign webpage of Senator Elizabeth Warren to use her “Cancel My Student Debt” calculator, answer a few questions and find out how much less debt you’d be saddled with under a Warren administration. On Bernie Sanders’ website, the process is even simpler. You answer just one question — “Do you have current student loan debt?” — and the page spits out the same answer for everybody: “You would owe $0” under Bernie’s “College for All” plan.

This is not meant to endorse a particular candidate. There are many very qualified challengers running in the 2020 election and I encourage anyone reading this to start doing your research if you haven’t yet. If you’ve only just tuned in, you might be forgiven for seeing this as some kind of race to the bottom to see who can make the most promises to the most people. But so long as we’re worried about The People voting themselves gifts from The Treasury, it’s worth remembering that the Republican Party’s plan to cut taxes for millionaires and billionaires cost this country more than canceling all current outstanding student debt would.

Forgiving student debt is a matter of financial priorities and moral imperatives. Quite simply: Isn’t it more important to guarantee that all people have access to as much of our accumulated knowledge as possible, than to keep pretending trickle-down economics works?

This conversation should be a fruitful one, however, as the Democratic primary continues to consciousness-raise about this issue. Working towards establishing debt-free (and eventually just free) public universities is the right thing to do from a moral and economic perspective, and it’s one of the surest ways to ensure incoming generations can continue to uplift themselves, improve their lives, contribute meaningfully to human society, and take part in the economy.

Every investment we make in public education is a gift to ourselves and incoming generations we’ll never meet, but who will thank us for building something that lasts. This was always the vision for public higher learning in America, right up until the regulatory capture and corporate takeover of the education industry.

How many Americans have student debt: 45 million

Total federal student debt in the U.S: Over $1,625,300,000,000

How much we should cancel: All of it#CancelStudentDebt pic.twitter.com/surS0JNpl7

— Bernie Sanders (@BernieSanders) June 24, 2019

But now that we’re speaking in a serious way about returning public colleges to the tuition-free status they enjoyed in the 1700s up through the 1960s in some cases, many in the public are decrying these plans to cancel student loan debt as “unfair” to those who’ve already spent the money and paid off the debt.

There are lots of problems with this mentality, each of which threatens to distract us from what a beautiful vision this really is for the future of America. So, let’s unpack those reasons now and hopefully put some minds at ease about the cost and the benefits of forgiving student loan debt.

Why Canceling Student Debt Is the Right Choice

One of the loudest voices in favor of canceling student loan debt is Alexandria Ocasio-Cortez, better known as “AOC.” But you’d need the world’s fastest stopwatch to clock the trolls’ response times when AOC mentions this subject on Twitter. In mere moments, the thread is filled with Gen Xers and Boomers trilling about how they paid off their student debts years ago, or ahead of schedule, and how folks shouldn’t be whining to the government to bail them out of debt they willingly took on.

Where are all these “Don’t Tread on Me” folks every time the RNC and DNC conspire to bail out automakers and bankers? Why aren’t they decrying the Republican Tax Scam? For the most part, those who oppose the expansion of America’s public services preach “financial conservatism” with extraordinary inconsistency.

Student loans are a scam.

That’s why I join @BernieSanders, @RepJayapal & @IlhanMN to forgive ALL student loans AND make colleges tuition-free.

PS: for the cost of the GOP tax scam (~$2 TRILLION), we could’ve already forgiven every student loan in America w/ billions left over. https://t.co/GXRHHWoKai

— Alexandria Ocasio-Cortez (@AOC) June 24, 2019

The interesting thing is, there’s nothing about student loan debt forgiveness that isn’t financially beneficial to the U.S. For a start, it would free 44.7 million Americans from having their wages garnished to the tune of $1.47 trillion. That’s how many debtors the mostly-privatized American higher education system has churned out, and how much money they collectively owe. These people want to take part in the economy. And they want to use the money they take home now to start businesses and generally participate in society — not generate dividends for Fannie Mae.

The mentality here seems to be that if a modern political candidate floats a proposal which stands to benefit somebody, somewhere, or even an entire class of person, but not me personally, then it’s okay to be indifferent and tune out. Here is the “fairness” backlash, helpfully condensed:

“I put in my hard work already, so everybody else should have to sacrifice like I did.”

Again, there’s so much wrong here.

The Baby Boomer generation had to put in 300 hours at work, at minimum wage, to pay for four years of college.

These days, it takes millennials more than 4,400 hours at the same wages to afford the same amount of education.

This didn’t just happen. This is the result of failing to babysit the people who write our tax codes, who declare war instead of building schools, and who are supposed to be making sure public universities can continue to compete realistically with more expensive private colleges.

Isn’t the whole point of human civilization to build something better for whoever comes after us?

Thankfully, we now have several credible presidential candidates who want to talk about building an America that values education and places fewer barriers between eager young people and the brighter future they keep hearing about. When older Americans say that we must work for what we want, and some of what we need, they’re correct. But they’ve been out of touch long enough that they don’t know how much less young people’s work (and money) is worth today than it was when they, themselves, were growing up.

Young people were promised a bright future for going to college. Yet, the jobs they were told to go to school for just aren’t there. Or if they are, they generally don’t pay enough for a college grad to pay off student loans while managing the cost of living. Thousands of dollars of student loan debt that rapidly accrues interest when unpaid is quite literally a prison to someone just starting out in the working world and earning only an entry-level salary. And at the age of 17 or 18, does anyone truly understand what it means to take on that much debt?

College Is a Public Service; There’s Nothing Unfair About Making It Free

Forgiving student debt and making public colleges tuition-free isn’t about “cherry-picking” certain people for preferential treatment. Some folks even call Bernie Sanders’ plan a gift to rich kids, compared with Warren’s plan, which would require tuition payments from wealthier families.

True “College for All” is a lot simpler than that: it seeks to add another public service to America’s current roster. Nobody’s rolling in their grave because they had to leave before America began staffing police stations (1838) or building public highways (1909).

Student loan debt is crushing millions of families. That’s why I’m calling for something truly transformational: Universal free college and the cancellation of debt for more than 95% of Americans with student loan debt. Read all about it here: https://t.co/IG9J5CiNb7

— Elizabeth Warren (@ewarren) April 22, 2019

Nobody who grew up before America sold out its higher education system by slashing funding should be preaching to millennials about fiscal responsibility. Our parents and grandparents, if they went to college, did so largely on the public dime. Young people today are asking for a similar chance to climb the ladder — and for nobody to burn it down behind them once they’re done climbing it.

The debate surrounding the “cost” and “value” of higher education cuts to another American issue, too: the type of people we want to be. One recent study showed that 80 percent of interviewed children said, when asked, that their parents were more concerned with their children’s success than whether or not they are caring people.

Can we raise more caring people? Could forgiving student debt help accomplish that, too? It’s more than possible. People who don’t have to fret about the essentials, like food, shelter, and water (and, yes, paying for their education) have more mental bandwidth left at the end of the day to practice charity and compassion, and to live their lives more thoughtfully and deliberately. Making the choice to invest in everybody’s future, no matter their background or upbringing, seems like a great way to create citizens who value kindness and success in equal measure.